- February 17, 2023

- 41 Views

DeFi is a new kind of investment that’s taking the world by storm. So what is it? Essentially, DeFi is a digital asset class that allows you to invest in cryptocurrencies and other digital assets using traditional financial instruments.

That means you can use DeFi platforms to buy and sell digital assets like bitcoin, ethereum, and more. And because DeFi is associated with traditional financial institutions, it’s stable and secure. However, it is always good to hire a trusted mobile app development company to build your DeFi Staking Platform.

This blog post will explore how to create a DeFi staking platform in 2023. Everything you should know before getting started.

-

Table of Contents

-

- 1. What is DeFi?

- 2. Different Types of DeFi Staking

- 3. How Does DeFi Staking Work?

- 4. 7 Advantages of DeFi Staking Solution Development

- 5. DeFi Staking Platform Features

- 6. How to Develop a DeFi Staking Platform?

- 7. How Much Does it Cost to Develop a DeFi Staking Platform?

- 8. What Does the Future Hold for DeFi?

- 9. Final Thoughts

- 10. FAQs

-

What is DeFi?

“$42.4B in value is locked in DeFi platforms (DeFiLlama).”

DeFi Staking is the process of locking up digital assets in a smart contract to earn rewards. It's similar to how you deposit money into a bank account, earning interest. The difference is that when you stake your assets, they are locked up in a blockchain network and can't be withdrawn until the staking period ends.

During this time, participants receive additional tokens from their investment as an incentive for providing liquidity to the network. Using DeFi Staking, users can earn passive income by simply holding onto their digital assets instead of actively trading them on exchanges. This incentivizes users to remain loyal to the platform, which helps stabilize its ecosystem and makes it more attractive for new investors.

Different Types of DeFi Staking

Here are three types of DeFi staking that are popular right now:

- Yield Farming: Yield farming is a relatively new concept in the world of decentralized finance where investors can earn rewards through liquidity provisioning across different protocols and platforms with various tokens being used as collateral for loans/borrowings, earning yield on locked up funds at various rates depending on the specific protocol/platform utilized.

- Staking: Staking is a way for investors to earn rewards by locking up their tokens in a smart contract and receiving payments over time. This process allows users to passively generate returns from their investments without having to monitor or trade the assets actively.

- Liquidity Mining: Liquidity mining is similar to yield farming but with one major difference: it requires liquidity providers (LPs) to hold certain amounts of different tokens for specific periods to receive rewards. LPs are incentivized through various reward structures, such as sharing transaction fees generated on the platform and also providing additional capital that can be used as collateral on loans/borrowings.

How Does DeFi Staking Work?

Now that you know what DeFi is, you might wonder how it works and what its benefits are. DeFi staking is a process that involves users depositing their cryptocurrency assets into a smart contract to earn rewards.

The deposited funds are used as collateral to secure loans, which gives borrowers access to the capital they wouldn't otherwise have access to. Additionally, when staking crypto-assets, users can receive rewards for providing liquidity or participating in the governance of decentralized projects/networks.

There are different types of DeFi protocols. However, all involve providing incentives for locking up digital assets and engaging with the network through various actions, such as voting on certain decisions or participating in governance processes. As more people stake their tokens, the price of those tokens increases, creating an opportunity for investors who want to invest early and reap future returns from increased demand.

7 Advantages of DeFi Staking Solution Development

Here are seven key benefits of DeFi staking solutions:

- Improved Liquidity: Staking helps improve liquidity by allowing users to transfer funds more easily between different protocols without any delays or extra fees incurred from third-party services such as exchanges. This makes it easier for investors to enter and exit positions quickly when needed, increasing overall market efficiency.

- Lower Transaction Fees: By reducing transaction costs through proof-of-stake consensus algorithms, DeFi staking solutions can help reduce fees associated with transactions that would otherwise be much higher if done on traditional networks like Ethereum or Bitcoin’s blockchain development services.

- Increased Security: As most DeFi projects rely on smart contracts, these applications benefit from greater security levels than their centralized counterparts due to their tamperproof nature and immutability features, making them highly resistant to malicious attacks and hacks.

- Enhanced Transparency: Through its open-source codebase, the DeFi project allows for greater transparency regarding its operations and performance. This helps to instill trust among users as they can closely monitor the workings of the platform.

- Improved Liquidity: DeFi staking solutions offer improved liquidity compared to traditional financing methods by allowing token holders to lend their tokens out to different projects and receive interest rates on them instead.

- Automatic Rebalancing: Since DeFi staking solutions are automated, they allow investors to rebalance their portfolios much more easily than with manual means. It eliminates human error and makes portfolio management faster, simpler, and more efficient overall.

- Higher Returns: Lastly, another great benefit of using a DeFI Staking Solution is that it generally offers higher returns than traditional investments due to its automated nature that ensures better pricing efficiency across markets.

DeFi Staking Platform Features

You can hire expert mobile app developers from a reliable software development company and ensure they include the following features in your DeFi staking platform.

The five standard features of a DeFi Staking Platform are:

- Rewards- Receive rewards for holding onto your crypto assets within the smart contract;

- Security- The platform is secured through cryptography and decentralized networks;

- Transparency- All stored information can be monitored and tracked by stakeholders;

- Liquidity- Users can easily trade their tokens or coins without restrictions;

- Automation- Platforms provide automation at low costs with no need for manual labor or third-party intermediaries needed when managing transactions on the network.

The five advanced features of a DeFi Staking Platform are:

- Yield Farming - Earn extra returns by staking cryptocurrencies in specific protocols such as Compound, Aave, Synthetix, etc.;

- Lending Services – Lend funds directly from the wallet, similar to traditional banks but with fewer restrictions;

- Governance Participation – Participate in crucial decisions and governance of DeFi protocols;

- Token Exchange – Easily exchange tokens from different blockchains without leaving the platform;

- Analytics Tools – Analyze market trends, portfolio performance, risk analysis, and other metrics.

How to Develop a DeFi Staking Platform?

- Research the Market: The first step in developing a DeFi staking platform is to do your research and gain an understanding of the market. To ensure you are creating a product that people will use and benefit from, it is important to know what competitors are doing, and any market gaps your platform could address.

- Develop Technology Requirements: Once you have done your market research, it’s time to start thinking about how you will build out your technology requirements for the DeFi staking platform. This includes outlining all the key components and functionality needed for the project, such as wallets, smart contracts, oracles, and other critical elements related to financial services.

- Design & Implement Architecture: After laying down all of your technical requirements, design and implement an architecture for deploying them onto a distributed ledger or blockchain network like Ethereum Blockchain or Quorum. It is important to analyze various design patterns available (e.g., proof-of-stake consensus algorithms) before deciding which one best fits with business goals/requirements while also providing users with high levels of security/privacy protection.

- Integrate Third-Party Services: Most DeFi staking platforms rely on third-party services to achieve full functionality. These services can include but are not limited to payment processors, identity verification systems, KYC/AML compliance solutions, and more. You must integrate these services as they are essential for your platform’s security and user experience. You should also consider the cost of integrating each service before deciding which ones to incorporate into your platform.

- Launch & Market Your Platform: Once all the pieces have been implemented and tested, it’s time to launch your DeFi staking platform! This process will involve deploying smart contracts onto a blockchain network like Ethereum or EOS so users can access them securely from anywhere in the world with an internet connection. Additionally, you’ll need to begin marketing campaigns through various channels, such as social media platforms and forums, so people know about your product and grow its user base quickly.

Also Read:- What Is DeFi? Guide to Decentralized Finance

How Much Does it Cost to Develop a DeFi Staking Platform?

The cost of developing a DeFi staking platform depends on several factors, such as the project's complexity, the development team's experience and expertise, and the technologies used.

Generally speaking, a basic DeFi staking platform with minimal features is estimated to cost around $20K to $30K. If more complex features are required, or additional integrations need to be built into the platform, then costs could easily range from $40K to even over $100K.

It's important to remember that developing your own DeFi Staking Platform involves numerous technical aspects that can significantly increase this price tag. Also, hosting and maintenance costs are associated with having a reliable infrastructure in place so that users can benefit from security and scalability when using your application.

What Does the Future Hold for DeFi?

The future of decentralized finance (DeFi) looks very promising. With the rise of cryptocurrencies, more and more people are starting to utilize DeFi protocols for their financial needs. As these technologies continue to evolve, so will the applications that can be built on top of them.

DeFi could eventually revolutionize banking as we know it and provide a fairer way for individuals to access financial services without relying on traditional institutions like banks.

Final Thoughts

To create a successful deFi platform, you first need to understand the importance of stakeholder alignment. Without an agreement between all stakeholders involved in your project, reaching your business goals will be nearly impossible.

This article provides a step-by-step guide to creating a stakeholder alignment plan and ensuring that everyone is on the same page from start to finish. By following these tips, you will be well on your way to creating a deFi platform that achieves success.

FAQs

What is DeFi Staking?

DeFi staking is a cryptocurrency investment system allowing users to earn passive income by depositing their tokens into a smart contract. The user will receive rewards based on the amount they have deposited and the time they have held it. This type of staking can be done with any ERC-20 token, such as Ethereum or EOS, on platforms like Uniswap or Compound.

Who should use a DeFi Staking Platform?

Generally speaking, anyone who holds cryptocurrency assets can benefit from using a DeFi staking platform since it offers additional ways to gain profits from their holdings. This can be especially beneficial to investors with moderate amounts of cryptocurrency. The staking rewards provide higher returns than traditional methods, such as trading or holding assets in a wallet.

How secure is my cryptocurrency when I use a DeFi Staking Platform?

Most DeFi staking platforms utilize state-of-the-art encryption technology and security measures which protect user funds against malicious activity and potential hacking attempts. It is also important to note that since these platforms operate on decentralized networks, users remain in complete control over their funds at all times, meaning they always know exactly where their money is going and who has access to it.

About Author

You May Also Like

How to Build a Fintech App - Everything You Should Know!

With the advent of technology, the financial industry has experienced a massive transformation in the past few years. Fintech applications have revolutionized the way we manage and invest our money.

Why Does Your Business Need a Food Delivery App and How to Get Started?

Businesses after COVID are going through several changes, and the food industry is no different. Restaurants that have been doing dine-in are now struggling to keep up with the demand for delivery and

How to Create a Payment Gateway? Everything You Should Know

Are you aware that the world is going through a significant shift in the way we make payments? According to a recent report by Deloitte, the total value of digital payments worldwide is estimated to r

Top 11 Advantages Of iOS Application Development For Your Business

Mobile applications play a vital role in the development of multiple businesses in this digital world. Most companies are investing in iOS app development to strengthen their market appearan

What Is DeFi? Guide to Decentralized Finance

Decentralized Finance (DeFi) is a modern and evolving region of finance that is less centralized and more open to innovation and collaboration. DeFi enthusiasts laud its prospect of disrupting convent

The Ultimate Guide to MVP Development

As the world of startups becomes increasingly competitive, building an MVP is crucial for entrepreneurs looking to test their ideas and launch successful businesses. By creating a minimum viable prod

A Guide to Blockchain App Development

Blockchain technology has been a hot topic recently due to its potential to revolutionize various industries. Blockchain is a distributed ledger technology that ensures transparency, security, and dec

How Much Does It Cost To Build A Streaming Service – A Step By Step Guide

The rise of online video streaming services has revolutionized the entertainment industry, prompting businesses worldwide to explore the possibility of launching their own platforms. With giants like

How to Make Learning Engaging through Gaming Technology?

What if you can combine the fun of gaming and the educational value of learning? This is an idea that has been gaining popularity in recent years as technology advances. There are several challenges

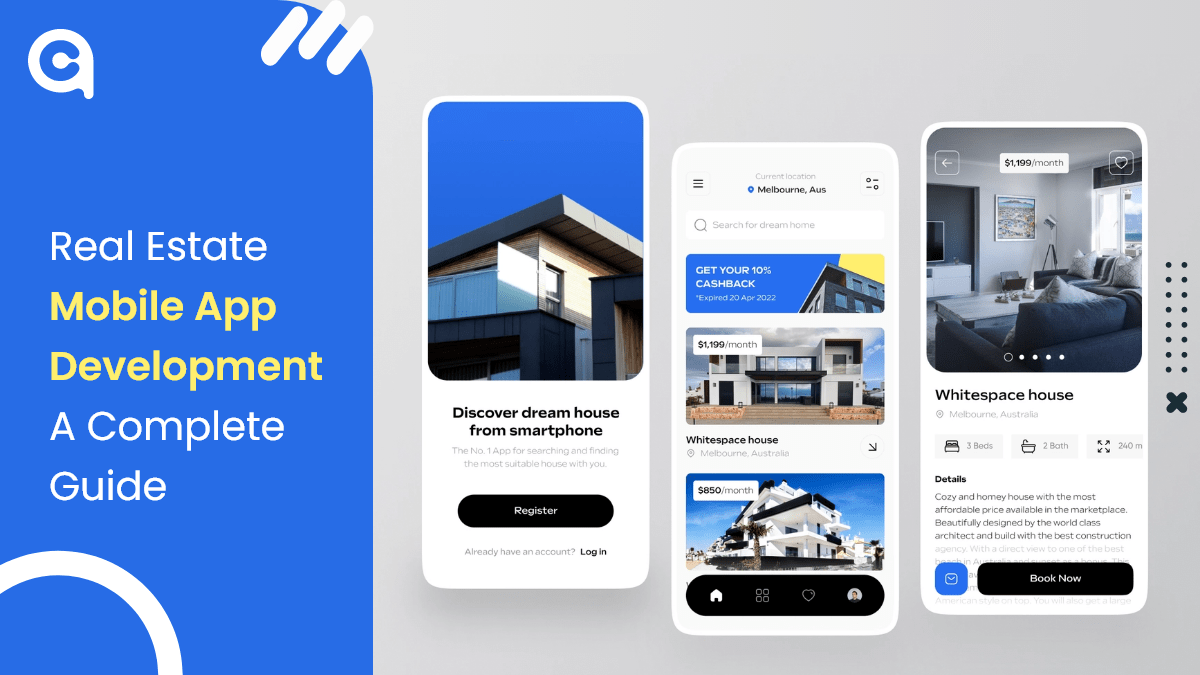

Real Estate Mobile App Development: A Complete Guide

The world is digitizing at a very rapid pace, and in such a scenario, real estate businesses must also go digital to stay ahead of the competition. One of the best ways to digitize your business is de

Find Out How Our Clients Reviewed Us On Clutch

It's no secret that the digital world has transformed many aspects of our lives, and it is only going to continue changing in ways we can't even imagine yet. To help businesses keep up with this rapid

How To Design A Social Media App and Features that Make it Popular?

Social media apps are all the rage these days. People use them to connect with friends and family, to learn about new products and services, and to stay up-to-date on the latest news. But as popular a

WWDC 2023 Overview: A Glimpse into Apple's Future

An extensive background working in Tech, Travel, and Education Industries. Currently involved in entire business operations process: Benefits strategy and implementation, systems integration, Human Re

How is Metaverse Presenting New Possibilities for Healthcare Businesses?

In the augmented reality world, the metaverse concept has gained significant attention. It represents the convergence of physical and virtual spaces, providing users with a platform to interact and en

What are dApps (Decentralized Apps) in Blockchain? Everything You Want to Know!

Blockchain iѕ a technology that enables thе creation оf digital property with a secure record оf ownership. It’ѕ the backbone of Bitcoin, thе firѕt аnd most well-known cryptocurrency. B

Latest Technology Trends That Trigger Android App Development Process

Do you run your own business and want to build an Android app? If yes, you must know about the latest technology trends playing a significant role in the android app development process. Technology i

Dubai Rest App: Your All-in-One Solution for Real Estate Services

Did you know that Dubai's prime residential market is projected to experience the world's strongest growth in 2023? The Middle East is buzzing with opportunities, especially in the realm of mobile app

Revealing Starbucks Marketing Strategy and What You Can Learn From It?

We all know that Starbucks is one of the most recognized coffee chains worldwide. It has over 24,000 stores in more than 70 countries. But why is Starbucks successful, and what marketing techniques do

Everything You Need to Know About Android 13 Beta 4

Google released Android 13 beta 4 to the public, and with it comes a slew of new features and updates. In this article, we'll walk you through everything you need to know about the latest version of A

Benefits and Use of Blockchain Technology in the Banking Industry

Picture this: a world where traditional banking transforms into a cutting-edge, efficient, and transparent system that leaves everyone in awe. Blockchain, often met with skepticism and uncertainty, is

iBeacon App Development - Key Challenges And Amazing Tips

Technology is proliferating with the advancement of time. The introduction of smartphones has changed the whole scenario right from communication to shopping. Users are now able to shop without moving

Healthcare App Ideas that Will Help You Succeed in 2022 and Beyond

As we head into the future, more and more people are looking to find ways to improve their healthcare. And with good reason - healthcare can be expensive, and it can be difficult to get the right care

Create a DeFi Staking Platform in 2023: A Complete Tutorial

DeFi is a new kind of investment that’s taking the world by storm. So what is it? Essentially, DeFi is a digital asset class that allows you to invest in cryptocurrencies and other digital asset

Digital Transformation With AI. Is your Organization Ready?

Do you know what digital transformation with AI is and how it can impact your business? Organizations today are under pressure to digitally transform to stay competitive. This digital transformation

Unveiling the Types of Blockchain Projects Reigning the Decentralized Economy

As blockchain technology continues to evolve, so too does the landscape of projects built on its foundation. The worldwide Blockchain market is predicted to expand at a CAGR of 42.8% (2018-2023), dire

How to Build a Taxi App Like Uber or Careem? Everything You Should Know!

Gone are the days when people used to wave down a taxi on the street or wait for one at the airport. With the advent of technology, people can now book a taxi with just a few taps on their smartphones

What are the Benefits of Using Digital Technology in Mobile App Development

With the ubiquity of smartphones and tablets, it only makes sense that mobile app development - which is the process of creating applications for smartphones and tablet devices - is becoming more popu

How to Launch a Metaverse Casino Game Like Blackjack 21- A Detailed Guide

The world of gaming is rapidly evolving, and the latest buzzword is "metaverse." The term refers to a virtual world where users can interact with each other and digital objects in real time, using imm

iOS App Development Guide for Business

Businesses these days are looking to have an edge over their competition by having a strong online presence. A website is not enough anymore, and many companies are turning to mobile apps as a way to

A Complete Guide to Implement AI and Machine Learning in Your Existing Application

When it comes to developing an app, there's a lot to consider. Not only do you need to create a user-friendly interface and design, but you also need to make sure your app is able to meet the demands

Blockchain and Web Development: The Intersection of Security and Trust

Blockchain technology and web development are two powerful innovations that have the potential to transform our world. While they may appear distinct, they share similarities and can work together to

Benefits of NFT Gamification To Transform Gaming Industry

In recent years, the gaming industry has seen a surge in popularity, with many gamers turning to online gaming platforms and console games in order to escape reality. With so many people playing video

Unveiling Top App Prototyping Platforms that You Must Use in 2022

When it comes to mobile app development, one of the most important things you need to consider is the prototyping process. This will allow you to create a working model of your app so that you can tes

Top 10 Reasons to Invest in Gaming App Development

The gaming industry is proliferating with the advent of smartphones and PCs. Every age group, from children to adults, is well-engaged and fond of online gaming. The rapid evolution of mobile gaming a

5G Launch Will Revolutionize the Mobile Industry: Know How!

Prime Minister Narendra Modi eventually launched 5G in India at the 6th edition of the IMC (India Mobile Congress). Reliance Jio and other telecom organizations documented the various use cases of 5G

How to Build an International Money Transfer App?

The introduction of online payment applications has changed how people perform financial transactions. A mobile phone with a banking app lets you quickly resolve various financial matters.

A Guide on How to Hire a Team of Remote Developers

Hiring a team of remote developers can be a daunting task, but it doesn't have to be. With a little bit of planning and the right approach, you can find the perfect candidates to build your dream prod

How to Build a Food Delivery App like Glovo? Everything you should know!

Have you ever found yourself in a situation where you desperately needed a product or service but didn't have the time or energy to go out and get it? Well, fear no more because on-demand delivery app

How Can Wearables Influence Mobile App Development Future?

In the last few years, wearables have become increasingly popular. Fitness trackers, smartwatches, and even smart glasses are becoming more and more commonplace. And as the technology improves and bec

Top Ways to Use Augmented Reality in Mobile Applications in 2022

Augmented Reality and Virtual Reality are the two leading buzzwords in the technology era. What began as a completely new, significantly different technology has rapidly revolutionized into something

How is Metaverse Impacting the Future of eCommerce?

Lately, the tech world has been abuzz with talk of the Metaverse, a groundbreaking concept that promises a shared virtual space where people can interact and engage with one another. This futuristic i

Node.JS 19 is Available! Here is What You Need to Know

The launch of Node.js 19 is now available! It substitutes Node.js 18 as the current launch line, with Node.js 18 being encouraged to long-term support (LTS) next week. What do these two launches mean

Legacy Application Modernisation: What It Is, Why You Need It, And How To Do It?

Mobile app development is quickly becoming a necessity for businesses. As the world becomes increasingly digital, companies of all sizes rely on mobile apps to reach customers and increase customer en

How to Develop a Video Conferencing App like Zoom?

Depending on what niche you’re in, video chat apps are becoming increasingly common in the world of business and technology. Whether it’s a small startup company or a multinational corpora

_replaceDesigningreplaceforoice-EnabledreplaceWebreplaceExperiences.png)

Voice User Interface (VUI): Designing for Voice-Enabled Web Experiences

Imagine a world where you can speak your thoughts and desires, and the digital realm responds promptly, seamlessly integrating into your daily life. Whether you want to search for information, contro

Top 7 Blockchain App Development Ideas to Boost up Business

Want to establish a new business or improve an existing one? You should consider using blockchain technology Being a distributed database, Blockchain allows for secure online transactions. This techn

What Makes Flutter Ideal For Cross-Platform App Development? - A Complete Guide

Table of Contents 1. What is Flutter? 2. Why Choose Cross-Platform Development? 3. Why is Flutter the Best Platform to Make Cross-platform Applications? 4. How Much Does it Cost to

Augmented Reality Trends of 2023: New Breakthrough in Alluring Technology

Technology has come a long way in the past decade, and augmented reality (AR) is one of the most exciting development fields. AR technology superimposes digital content into the real world, creating a

Guide to Design Mobile App in 2022 | Everything You Need to Know

Are you looking to design a mobile app in 2022? Well, mobile application development is an ever-changing field, and it can be hard to keep up with the latest trends and best practices. But w

ChatGPT: Unlocking A New Wave Of AI-Powered Conversational Experiences

Table of Contents 1. What is ChatGPT? 2. What Are the Top Benefits of ChatGPT? 3. How Does ChatGPT Work? 4. Challenges With ChatGPT 5. ChatGPT and the Future of AI 6. Final Thoug

Top New Blockchain Technology Trends to Follow in 2023

Picture this - a world where business transactions are seamless, secure, and transparent. This might have seemed like a distant dream before the advent of cryptocurrencies and blockchain technology, b

The Benefits of Integrating AR and VR in E-Learning Platforms

Imagine a classroom where history comes alive in the 3D model of historical events. Biology students can explore the unique complexities of a cell as they have practiced it with real-world examples, a

Flutter vs. React Native: Which One is Better for Mobile App Development?

The two hottest frameworks in the mobile app development world are Flutter and React Native. They’re both cross-platform solutions that allow you to write code once and deploy it to Android and

Top Tech Trends That Will Define the Next Decade of Business

By 2024, we all know that technology will be the future. What excites me the most is that technology has covered all the dimensions of businesses, enabling them to attain their potential and efficienc

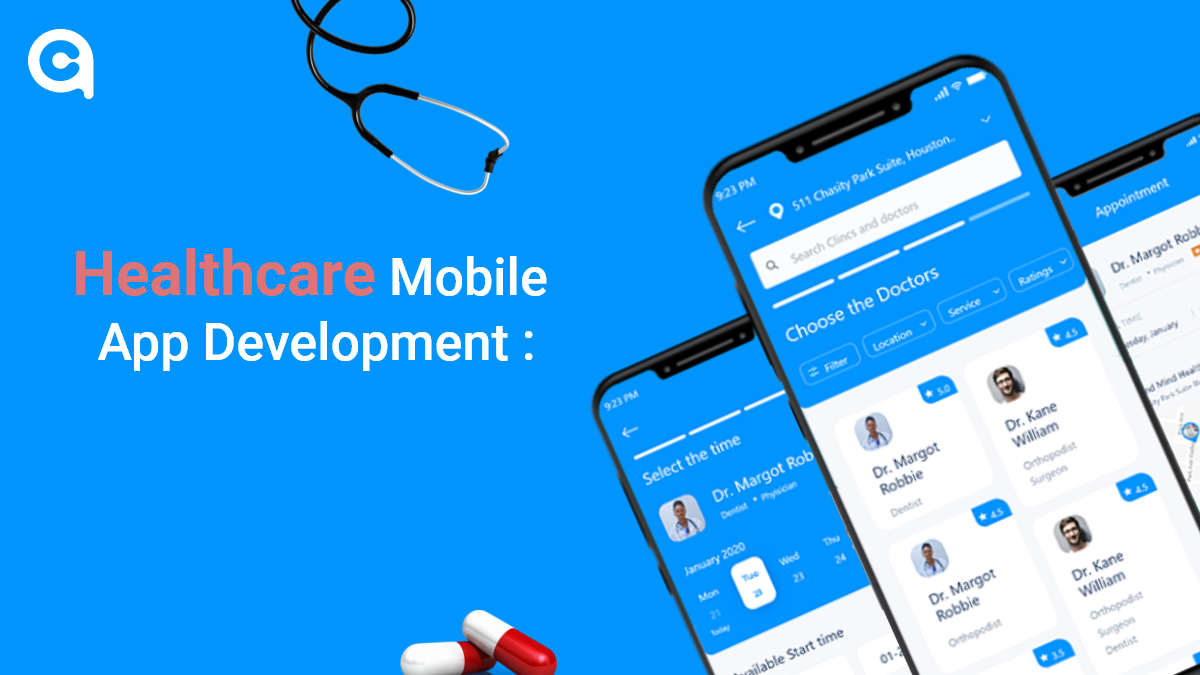

Healthcare Mobile App Development: A Complete Tutorial

The healthcare industry is one of the most rapidly changing and growing industries worldwide. Mobile devices and apps have drastically changed how providers and patients interact and communicate.So, i

How to Build HIPAA Compliant Healthcare Apps: Everything You Should Know!

If you’re in the healthcare industry, then you know that data privacy and security are of utmost importance. In order to protect patients’ information, the Health Insurance Portability and

9 Things Users Want from a Mobile App

The mobile app market has grown to a staggering size, with over 1.8 million apps available in the Google Play Store and Apple App Store combined. Mobile apps have become a necessity for peop

.png)

How to create the first gaming app in 2024?

Application development is essential to fostering business efficiency while accepting new changes. Depending on the specific requirements, 85% of businesses rely on software development solutions to s

How To Create A Money Transfer App? Everything You Should Know

Nowadays, the financial industry has encountered massive digitization, and mobile apps play a significant role in it. There are a wide variety of money transfer apps available, catering to the needs a

The Rise of Progressive Web Apps (PWA): Enhancing User Experiences

In today's digital world, businesses must keep up with ever-increasing consumer expectations and find new ways to engage their audience. That's where Progressive Web Apps (PWAs) come in. PWAs are a r

Steps to Keep in Mind To Build Your Next Gaming App With Zero Coding!

Do you want to build a simple app for your business? Do you want to create an app that enhances the experience of users who play games on their smartphones? Whatever your reason, I have created this g

Leave a Reply

Your email address will not be publishedDO YOU HAVE ANY PROJECT

Let's Talk About Business Solutions With Us

India Address

57A, 4th Floor, E Block, Sector 63, Noida, Uttar Pradesh 201301

Call Us

+91 853 500 8008

Email ID

[email protected]