- May 06, 2022

- 78 Views

Nowadays, the financial industry has encountered massive digitization, and mobile apps play a significant role in it. There are a wide variety of money transfer apps available, catering to the needs and preferences of different customers. These apps allow users to easily and quickly send or receive funds from anywhere in the world at any time.

But how to create your own money transfer app? If this is the question you are looking for the answer to, then you have come to the right place. Today, I will give you a thorough guide on how to design mobile app for money transfer.

Let's begin with some more information about money transfer apps.

-

Table of Contents

-

- 1. Money Transfer Apps- Market Overview

- 2. What Are the Benefits of the Money Transfer App?

- 3. Types of Money Transfer Apps

- 4. What Core Features Your Mobile Transfer App Should Have?

- 5. 5 Advanced Features Your Money Transfer Apps Should Have

- 6. How Much Does it Cost to Develop a Money Transfer App?

- 7. How to Develop a Money Transfer App? 7 Steps to Follow

- 8. Final Thoughts

-

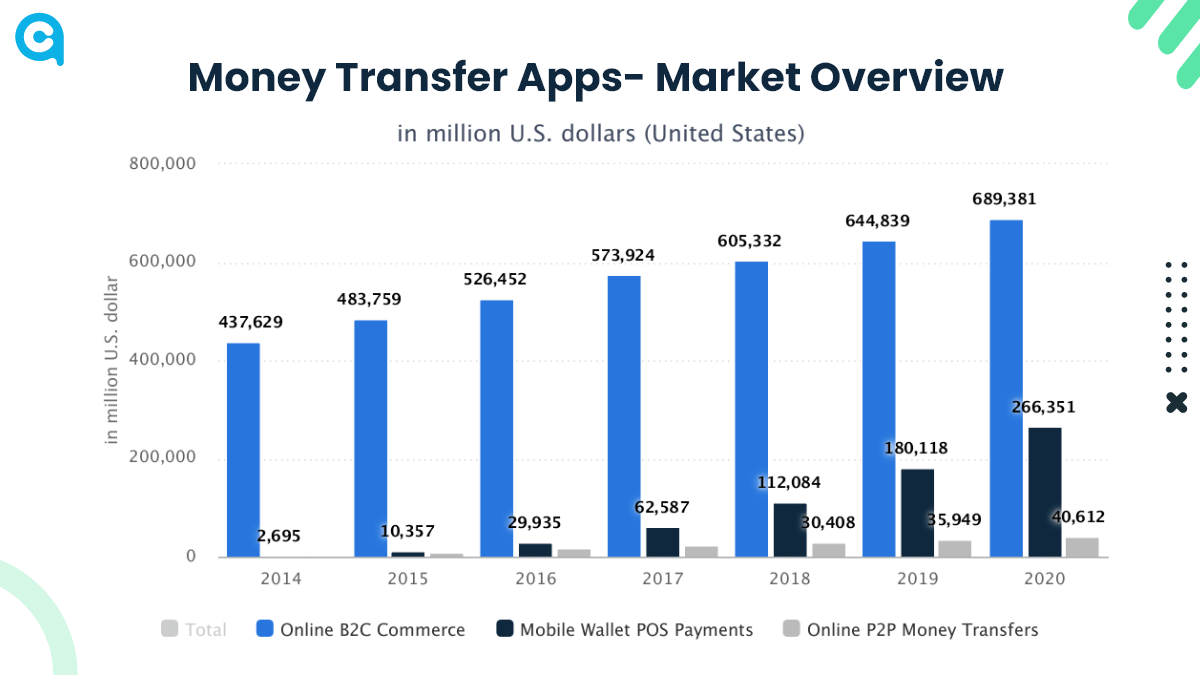

Money Transfer Apps - Market Overview

The money transfer app market is constantly evolving. In 2021, the global money payment market was valued at USD 40.59 billion. It is predicted to grow at a CAGR of 35.3% from 2022 to 2030.

Several factors are driving the increasing demand for money transfer apps. These include the growing use of smartphones and mobile internet, advancements in digital payment technologies, rising penetration of e-commerce platforms, increasing disposable incomes in emerging economies, etc.

What Are the Benefits of the Money Transfer App?

Money transfer mobile apps have become an essential part of our lives as they allow us to quickly and easily send or receive money from anywhere in the world. Some of the key benefits of using a money transfer app include:

- Convenience:With just some taps on your mobile device, you can easily send or receive money from anyone, no matter where they are located.

- Speed: Money transfer apps provide a quick and easy way to send or receive money, often within minutes.

- Security: Most money transfer apps use secure channels to transfer money to ensure that your personal and financial information is safe.

- Low Fees: Some money transfer apps charge very low or no fees at all, making them an affordable option for sending or receiving money.

Types of Money Transfer Apps

Several mobile apps can be used to transfer money, including peer-to-peer (P2P) transfer apps and bank transfer apps. Some specific examples of these different types of money payment apps include:

- PayPal: One of the most popular and well-known money transfer apps, PayPal allows users to quickly and easily send or receive money from anywhere.

- Venmo: Another popular P2P money transfer app, Venmo is known for its ease of use and social media integration.

- Zelle: A bank transfer app that allows users to quickly and easily send or receive money from their mobile devices.

- Cash App: A P2P money transfer app that offers users a variety of features, including the ability to buy and sell Bitcoin.

What Core Features Your Mobile Transfer App Should Have?

To make a mobile app successful there are a lot of points to be considered like: things users want from a mobile app, etc. and when it comes to a money transfer app, several critical features must be included to create a successful money transfer app. Some key features to consider when developing your money transfer application include:

1. Easy sign-up and onboarding process

This is one of the essential features of a money transfer app, as it should be easy for users to sign-up and get started with the app. The sign-up process should be quick and simple, and the app should provide an onboarding experience that is clear and concise.

2. Social media integration

Another key feature of a money transfer app is social media integration. This feature allows users to easily connect their Facebook or Twitter accounts to the app to easily and quickly send money to their contacts.

3. Push notifications

Push notifications are a key feature of any mobile app as they help keep users engaged with the app. For a money transfer app, push notifications can be used to notify users of new transactions or remind them to send money to their contacts.

4. Location-based features

Location-based features are also crucial for a money transfer app as they allow users to find nearby ATMs or branches of their bank easily.

5. Currency conversion

This is a critical feature for any money transfer app, as it allows users to view the current conversion rate for their selected currency easily. Users can easily estimate their transaction costs and budget accordingly with this information.

6. Security features

For any online money transfer app, security is of the utmost importance. This includes the use of secure channels to send and receive funds, as well as the use of strong authentication methods to protect user accounts. Other security features that may be included in a money transfer app include setting a PIN code for the app or using fingerprint or face recognition to unlock the app.

5 Advanced Features Your Money Transfer Apps Should Have

Apart from the key features mentioned above, several other advanced features can help make your money transfer app stand out from the crowd. Some of these advanced features may include:

1. Integration with financial institutions

Some money transfer apps integrate directly with financial institutions, giving users access to their bank accounts and allowing them to transfer money between their bank account and the app easily.

2. Payment options

In addition to transferring funds directly from one user to another, some money transfer apps also offer various payment options, including the ability to pay bills or make a purchase directly through the app.

3. Multi-currency support

If you want to cater to a broad range of users, some money transfer apps offer multi-currency support, allowing users to send and receive funds in various currencies.

4. Support for cryptocurrencies

In recent years, cryptocurrencies like Bitcoin have become increasingly popular as a way to make payments. Some money transfer apps also offer support for cryptocurrencies, allowing users to send and receive funds using their favorite cryptocurrency easily.

5. Integration with social media platforms

Another advanced feature included in a money transfer app is integration with popular social media platforms like Facebook or Twitter. This allows users to easily share transactions or send payments via these platforms, helping to increase the reach of your app and grow your user base.

How Much Does it Cost to Develop a Money Transfer App?

The cost of building a money transfer app will vary depending on several factors, including the features and functionality you wish to incorporate in your app, the platform you want to develop for, and the experience and expertise of your chosen development team.

If you want to get an accurate estimate of the cost of developing a money transfer app, it is vital to work with a leading mobile app development agency with experience in this field. These are the factors that can impact the cost of your app:

- The number and complexity of features included in your app.

- Whether you are going for android or iOS app development.

- The experience and expertise of your chosen mobile app developers.

- The geographic location of your development team.

When it comes to the cost of developing a money transfer app, it is important to note that you get what you pay for. If you choose to work with a cheap or inexperienced development team, you may end up with an app that is not up to par with the competition and does not meet your business needs. By investing in a quality development team, you can be sure that your money transfer app will be a success.

How to Develop a Money Transfer App? 7 Steps to Follow

Are you looking to develop a money transfer app? Here are the steps that will help you create a money transfer app.

1. Choose your business model

The first step is to choose which business model you want to use for your money transfer app. There are two options: peer-to-peer (P2P) transfers, where you connect directly with customers and allow them to transfer funds using your app, or business-to-business (B2B), where you partner with other businesses or companies that want to offer money transfer services.

2. Register as a money transmitter

If you're planning on offering P2P money transfers directly to customers, you will need to register as a money transmitter with your local government. This typically involves submitting an application and providing details about the nature of your business, including how you plan to comply with all relevant regulations.

3. Integrate payment processing into your app

Once you've registered as a money transmitter, you'll need to integrate payment processing into your app. This will allow customers to connect their bank accounts or credit cards and initiate transfers using your app.

4. Choose a money transfer provider

If you're planning on offering B2B money transfers, you'll need to partner with a money transfer provider. There are numerous providers to pick from, so it's crucial to compare their fees, exchange rates, and other features to find the best fit for your business.

5. Develop the user interface and user experience

The next step is to develop the user interface (UI) and user experience (UX) for your app. This includes designing the app's overall look and feel and creating a streamlined, user-friendly interface that makes it easy for customers to send and receive money.

6. Test your app and launch it to the public

Once your mobile app is ready, you'll need to test it thoroughly to ensure that all its features are working properly. Then, you can launch your app to the public and start marketing it to potential customers.

7. Monitor your app's performance and make changes as needed

After launching your app, it's important to monitor its performance and make changes as needed. This includes adding new features, updating the UI/UX, and improving customer support. By constantly monitoring and improving your app, you can ensure that it remains popular and valuable to users.

Final Thoughts

Whether you are looking to develop a money transfer app for personal use or offer a new payment service for your business, there are many important considerations to consider. It is essential to focus on features that are both secure and user-friendly to ensure the success of your app.

In addition, it is important to work with a reputable mobile app development company that has experience in developing money transfer apps to get an accurate estimate of the cost of your project. By considering all the above-mentioned factors, you can be confident that your money transfer app will be a success.

About Author

You May Also Like

In the last few years, wearables have become increasingly popular. Fitness trackers, smartwatches, and even smart glasses are becoming more and more commonplace. And as the technology improves and bec

The mobile app market has grown to a staggering size, with over 1.8 million apps available in the Google Play Store and Apple App Store combined. Mobile apps have become a necessity for people worldwi

Prime Minister Narendra Modi eventually launched 5G in India at the 6th edition of the IMC (India Mobile Congress). Reliance Jio and other telecom organizations documented the various use cases of 5G

Are you looking to design a mobile app in 2025? Mobile application development is an ever-changing field, and it can be hard to keep up with the latest trends and best practices. But with this guide,

Will DeepSeek and ChatGPT collide in the race for AI Supremacy? DeepSeek and ChatGPT are at the center of a heated debate that tends to shape the future of AI. The real-world implications and effecti

Decentralized Finance (DeFi) is a modern and evolving region of finance that is less centralized and more open to innovation and collaboration. DeFi enthusiasts laud its prospect of disrupting convent

Augmented Reality and Virtual Reality are the two leading buzzwords in the technology era. What began as a completely new, significantly different technology has rapidly revolutionized into something

If you’re in the healthcare industry, then you know that data privacy and security are of utmost importance. In order to protect patients’ information, the Health Insurance Portability and

You’ve likely heard the term “Artificial Intelligence” or AI until now—It’s 2025. But have you ever paused to consider how deeply AI has woven itself into the web of our

It's no secret that the digital world has transformed many aspects of our lives, and it is only going to continue changing in ways we can't even imagine yet. To help businesses keep up with this rapid

Over-the-top (OTT) platforms like Disney Plus, Netflix, and Prime Video have gradually captured attention as traditional TV-watching methods have faded. Throughout the year, OTT platforms have created

The world is digitizing at a very rapid pace, and in such a scenario, real estate businesses must also go digital to stay ahead of the competition. One of the best ways to digitize your business is de

The introduction of online payment applications has changed how people perform financial transactions. A mobile phone with a banking app lets you quickly resolve various financial matters. Ta

The gaming industry is proliferating with the advent of smartphones and PCs. Every age group, from children to adults, is well-engaged and fond of online gaming. The rapid evolution of mobile gaming a

Blockchain technology and web development are two powerful innovations that have the potential to transform our world. While they may appear distinct, they share similarities and can work together to

Table of Contents 1. What is Flutter? 2. Why Choose Cross-Platform Development? 3. Why is Flutter the Best Platform to Make Cross-platform Applications? 4. How Much Does it Cost to

Social media apps are all the rage these days. People use them to connect with friends and family, to learn about new products and services, and to stay up-to-date on the latest news. But as popular a

When it comes to mobile app development, one of the most important things you need to consider is the prototyping process. This will allow you to create a working model of your app so that you can tes

Nowadays, the digital presence has revolutionized business dynamics. App development is not just evolving but breaking traditional barriers and emerging as strong and progressive solutions. With robus

Summary: Car rental apps have become the heart of the business, stimulating growth, efficiency, and customization. They offer updated rental methods to stay relevant with Gen Z and Millennials, who ar

The two hottest frameworks in the mobile app development world are Flutter and React Native. They’re both cross-platform solutions that allow you to write code once and deploy it to Android and

Google released Android 13 beta 4 to the public, and with it comes a slew of new features and updates. In this article, we'll walk you through everything you need to know about the latest version of A

Businesses after COVID are going through several changes, and the food industry is no different. Restaurants that have been doing dine-in are now struggling to keep up with the demand for delivery and

Sipping coffee and thinking of a startup has always been trendy. Similarly, hanging out with friends and promising them to start a business someday feels refreshing. Did you know that several success

Want to establish a new business or improve an existing one? You should consider using blockchain technology Being a distributed database, Blockchain allows for secure online transactions. This techn

The mobile app market has grown to a staggering size, with over 1.8 million apps available in the Google Play Store and Apple App Store combined. Mobile apps have become a necessity for people worldwi

The healthcare industry is one of the most rapidly changing and growing industries worldwide. Mobile devices and apps have drastically changed how providers and patients interact and communicate.So, i

The food delivery application has innovative, game-changing features that will transform the industry from the bottom to the top. According to Statista, the online food delivery market in the UAE has

In recent years, the gaming industry has seen a surge in popularity, with many gamers turning to online gaming platforms and console games in order to escape reality. With so many people playing video

Businesses these days are looking to have an edge over their competition by having a strong online presence. A website is not enough anymore, and many companies are turning to mobile apps as a way to

Hiring a team of remote developers can be a daunting task, but it doesn't have to be. With a little bit of planning and the right approach, you can find the perfect candidates to build your dream prod

Necessity is the mother of invention origin! Have you ever wondered when an entrepreneur decides to start a business? When demand is high and supply is low, opportunities arise. But there’s mor

Have you ever found yourself in a situation where you desperately needed a product or service but didn't have the time or energy to go out and get it? Well, fear no more because on-demand delivery app

The world of gaming is rapidly evolving, and the latest buzzword is "metaverse." The term refers to a virtual world where users can interact with each other and digital objects in real time, using imm

Did you know that Dubai's prime residential market is projected to experience the world's strongest growth in 2025? The Middle East is buzzing with opportunities, especially in the realm of mobile app

IPTV has established itself as a prominent technology that is gaining traction with its comprehensive platform applications. Unlike traditional methods like satellite, cable, or TV, IPTV has accelera

The launch of Node.js 19 is now available! It substitutes Node.js 18 as the current launch line, with Node.js 18 being encouraged to long-term support (LTS) next week. What do these two launches mean

Imagine a world where you can speak your thoughts and desires, and the digital realm responds promptly, seamlessly integrating into your daily life. Whether you want to search for information, contro

Picture this - a world where business transactions are seamless, secure, and transparent. This might have seemed like a distant dream before the advent of cryptocurrencies and blockchain technology, b

As blockchain technology continues to evolve, so too does the landscape of projects built on its foundation. The worldwide Blockchain market is predicted to expand at a CAGR of 42.8% (2018-2023), dire

With the advent of technology, the financial industry has experienced a massive transformation in the past few years. Fintech applications have revolutionized the way we manage and invest our money.

Things have changed dramatically over the years with new opportunities, techniques, and future advancements. Real estate is the best industry to invest in, though the procedure sometimes irritates. Me

Nowadays, the financial industry has encountered massive digitization, and mobile apps play a significant role in it. There are a wide variety of money transfer apps available, catering to the needs a

Have you ever felt like you’ve attracted 30% more consumers to your shopping sales by using a technical hack to revive your shops? It would work like a person was crossing through next to your

Is your business still relying on off-the-shelf software solutions that don’t efficiently meet your unique business requirements? If your mind instantly says yes, then let’s explore why in

Picture this: a world where traditional banking transforms into a cutting-edge, efficient, and transparent system that leaves everyone in awe. Blockchain, often met with skepticism and uncertainty, is

Do you know what digital transformation with AI is and how it can impact your business? Organizations today are under pressure to digitally transform to stay competitive. This digital transformation

The beacon technology market was valued at 519.6 million U.S. dollars in 2016, and it was estimated to increase at a CAGR of 59.8% to reach about 56.6 billion U.S. dollars in size in 2026. Throughout

Are you aware that the world is going through a significant shift in the way we make payments? According to a recent report by Deloitte, the total value of digital payments worldwide is estimated to r

Mobile app development is quickly becoming a necessity for businesses. As the world becomes increasingly digital, companies of all sizes rely on mobile apps to reach customers and increase customer en

Rental businesses are gaining market share by offering essential services that help other businesses minimize downtime and maximize profitability. This growth trend is particularly strong in the servi

As we head into the future, more and more people are looking to find ways to improve their healthcare. And with good reason - healthcare can be expensive, and it can be difficult to get the right care

Do you want to build a simple app for your business? Do you want to create an app that enhances the experience of users who play games on their smartphones? Whatever your reason, I have created this g

By 2024, we all know that technology will be the future. What excites me the most is that technology has covered all the dimensions of businesses, enabling them to attain their potential and efficienc

Can you give thought to a week without coffee breaks at cafes? It might not be possible, but earlier, having coffee outside the house was never a thing. So how the tables have changed the corners?

The rise of online video streaming services has revolutionized the entertainment industry, prompting businesses worldwide to explore the possibility of launching their own platforms. With giants like

Application development is essential to fostering business efficiency while accepting new changes. Depending on the specific requirements, 85% of businesses rely on software development solutions to s

Australia is moving towards a big shift at a global level. It is strengthening the ties at the B2B level and becoming a hub for innovation, sustainability, and digital transformation. Backed with a r

Lately, the tech world has been abuzz with talk of the Metaverse, a groundbreaking concept that promises a shared virtual space where people can interact and engage with one another. This futuristic i

Depending on what niche you’re in, video chat apps are becoming increasingly common in the world of business and technology. Whether it’s a small startup company or a multinational corpora

Over the past decades, the healthcare sector has continuously expanded its wings, moving from traditional to advanced technological processes. This evolution is driven by the sector's unwavering commi

In today's digital world, businesses must keep up with ever-increasing consumer expectations and find new ways to engage their audience. That's where Progressive Web Apps (PWAs) come in. PWAs are a r

Blockchain technology has been a hot topic recently due to its potential to revolutionize various industries. Blockchain is a distributed ledger technology that ensures transparency, security, and dec

If you’re planning to enter the fast-growing fantasy sports market, one of the most critical aspects considered is “What will it cost to build a fantasy sport that stands out and drives t

DeFi is a new kind of investment that’s taking the world by storm. So what is it? Essentially, DeFi is a digital asset class that allows you to invest in cryptocurrencies and other digital asset

Technology has come a long way in the past decade, and augmented reality (AR) is one of the most exciting development fields. AR technology superimposes digital content into the real world, creating a

The startup space is fast, competitive, and harsh. According to Exploding Topics, about 90% of startups fail. What would be the reason for that? There would be multiple reasons for startup failure, bu

Mobile applications have dominated the market, helping businesses to reinforce their full potential. Not only for the rental business, but mobile apps play a critical role in establishing a solid foun

Table of Contents 1. What is ChatGPT? 2. What Are the Top Benefits of ChatGPT? 3. How Does ChatGPT Work? 4. Challenges With ChatGPT 5. ChatGPT and the Future of AI 6. Final Thoug

The UAE, and Dubai specifically, has really evolved from just a real estate and tourism market, and is quickly becoming a hub for digital innovation and online commerce. With the continued investment

Having a mobile application is no longer a luxury—it's an essential tool for instantly capturing the market! To stand out in the rental businesses, a company must adopt tech-driven preferences

The United Arab Emirates (UAE) is flourishing as the hub for blockchain technologies, transforming the digital ecosystem and having a forward-thinking government to maintain its competitive edge. Gove

With the ubiquity of smartphones and tablets, it only makes sense that mobile app development - which is the process of creating applications for smartphones and tablet devices - is becoming more popu

Imagine a classroom where history comes alive in the 3D model of historical events. Biology students can explore the unique complexities of a cell as they have practiced it with real-world examples, a

When it comes to developing an app, there's a lot to consider. Not only do you need to create a user-friendly interface and design, but you also need to make sure your app is able to meet the demands

Blockchain technology is becoming the heart of multiple industries. It is robustly securing businesses through its core value, making it the first pick-up in the generative AIs. The blockchain is the

Generative AI? Is this still a question mark to you? If you don’t know what generative AI does, that would be a fair question, but it was not if you said that you haven’t interacted with

Building an App that promotes businesses and acts as a right hand has a separate fanbase! Creating an app for the business plays a fundamental role in elevating business operations, making seamless c

Gone are the days when people used to wave down a taxi on the street or wait for one at the airport. With the advent of technology, people can now book a taxi with just a few taps on their smartphones

Do you run your own business and want to build an Android app? If yes, you must know about the latest technology trends playing a significant role in the android app development process. Technology i

An extensive background working in Tech, Travel, and Education Industries. Currently involved in entire business operations process: Benefits strategy and implementation, systems integration, Human Re

Mobile applications play a vital role in the development of multiple businesses in this digital world. Most companies are investing in iOS app development to strengthen their market appearance and dra

As the world of startups becomes increasingly competitive, building an MVP is crucial for entrepreneurs looking to test their ideas and launch successful businesses. By creating a minimum viable produ

Leave a Reply

Your email address will not be publishedDO YOU HAVE ANY PROJECT

Let's Talk About Business Solutions With Us

India Address

57A, 4th Floor, E Block, Sector 63, Noida, Uttar Pradesh 201301

Call Us

+91 853 500 8008

Email ID

[email protected]

.jpg)